Trade Crypto CFDs

Access the global crypto CFD market with competitive spreads and leverage.

Crypto CFDs

Cryptocurrency CFDs (Contracts for Difference) are derivative trading instruments that allow traders to speculate on the price movements of cryptocurrencies without owning the actual digital assets. In essence, cryptocurrency CFDs let you bet on whether the price of a specific cryptocurrency, such as Bitcoin or Ethereum, will rise or fall.

Virtual currency pairs are typically composed of two currencies. One currency is called the ‘base currency,’ and the other currency is called the ‘counter currency.’ The base currency serves as the price benchmark, while the counter currency is used to represent that price. In other words, the price displayed on the exchange is the price of one unit of the counter currency per unit of the base currency. For example, in the BTC/USD pair, Bitcoin (BTC) is the base currency, and the US Dollar (USD) is the counter currency. The price of this pair indicates the price of one Bitcoin in US Dollars.

Why trade with Swift Trader

Crypto CFD Facts

- Up to 1:1000 leverage

- Razor-thin spreads from 0.0 pips

- Deep liquidity

- Trade 24 hours a day, seven days a week

- Trade in any direction, go long or short

Discover our competitive spreads

MT-5

- Standard

- Mini

- Micro

- PRO

- ECN

| Symbol | Bid Price | Ask Price | Spread |

|---|

How Trading Crypto CFDs Works

Cryptocurrency CFDs are a popular way for traders to access the volatile crypto markets without the complexity of owning and managing digital assets directly.

Cryptocurrency CFD Trading:

- Going Long (Buy): ou predict that Bitcoin will increase in value. You open a long CFD position when Bitcoin is valued at $25,000. If the price rises to $26,000, you can close the position and profit from the $1,000 price difference.

- Going Short (Sell): You believe Bitcoin’s price will drop. You open a short CFD position when Bitcoin is valued at $25,000. If the price falls to $24,000, you close the position and profit from the $1,000 drop.

- Trade 24 hours a day, 365 days: Cryptocurrency CFDs can be traded 24/7, reflecting the round-the-clock nature of the cryptocurrency markets.

- Up to 1000x leverage available Close your position when your target is met or if you wish to cut losses. The profit or loss is calculated based on the difference between the opening and closing prices.

Benefits of Trading Cryptocurrencies CFDs:

No Digital Wallet requirement: When trading cryptocurrency CFDs, there’s no requirement to have a digital wallet or sign up with an exchange. Traders are not responsible for holding the actual cryptocurrency or ensuring its security.

Leverage: CFD trades are leveraged, allowing traders to open positions with only a portion of the total trade value as a margin deposit. This gives traders significant exposure to the cryptocurrency market with a smaller initial investment. Leverage also increases exposure to volatility and risk.

Choice: The wide range of CFD options in the crypto market makes it easy to diversify your trading strategies.

Advanced Trading Platforms: Cryptocurrency CFDs can be traded seamlessly using advanced platforms like MetaTrader 4/5. These platforms simplify the trading process and the overall trading experience.

What crypto CFDs can be traded:

Overview: Some of the most popular crypto CFDs involve Bitcoin, Ethereum, Litecoin and Ripple or one of its derivatives as a base currency. These include:

• BTC/USD

• BCH/USD

• ETH/USD

• LTC/USD

• XRP/USD

Liquidity Providers:

Role: Liquidity providers are financial institutions that facilitate trading by offering buy and sell prices for currency pairs. They ensure that traders can execute trades efficiently and at competitive prices.

Types: Major banks and financial institutions act as liquidity providers. They offer tight spreads and deep liquidity, which helps to maintain market stability and minimise slippage.

Technology and Infrastructure:

Equinix Servers: Swift Trader utilises Equinix servers, which are strategically located in major financial hubs to ensure low latency and fast execution times. Equinix’s high-performance infrastructure enhances connectivity and reliability, providing traders with a seamless trading experience.

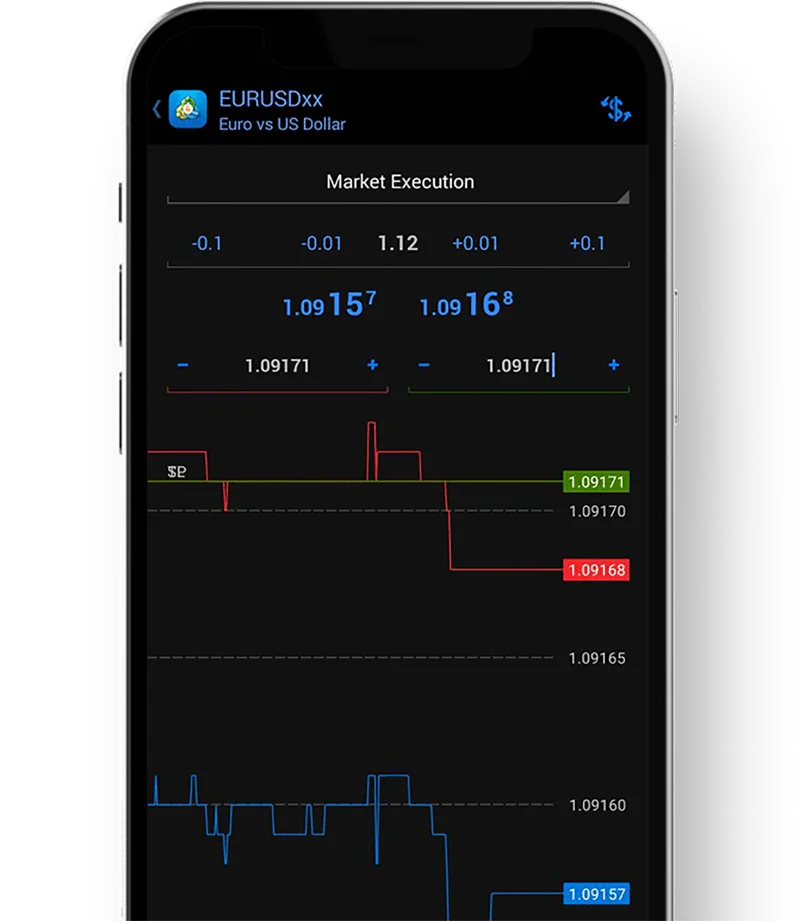

Advanced Platforms: Our trading platforms, MT5, is designed to handle high-frequency trading and large volumes with minimal latency. Features include real-time quotes, advanced charting tools, and customisable trading indicators.

Get Started - Sign up and access the Crypto CFD Markets

Swift Trader offers one of the most competitive trading experiences globally. Gain access to the world’s largest and most liquid market with raw spreads starting as low as 0.0 pips.

What Swift Trader Offers

By offering Forex CFDs, Swift Trader provides traders with the tools and infrastructure needed to navigate the dynamic forex market and capitalise on trading opportunities.

Key benefits of Forex CFDs with Swift Trader

Forex CFDs provides a number of benefits which must be weighed against the risks of using them. Some of the benefits of Forex CFDs are as follows:

Automated trading

Custom leverage options

Hedge your exposure

Trade from anywhere

Profit in both ways

Tailored to suit

What makes Swift Trader preferred by traders

Discover why traders choose Swift Trader for its unbeatable combination of advanced tools, fast execution, and competitive trading conditions.

Sincerity of Customer Support

Raw spreads from 0.1 pips

Micro lots available

Up to 1:400 Leverage

Negative Balance Protection

300+ trading instruments

Crypto as a funding method

Fast withdrawals

3 Step account opening

Trade CFDs Like a Pro with MetaTrader 5

- Real-time price quotes

- Advanced charting tools

- Customisable trading indicators

- One-click trading