Trade Precious Metal CFDs

Access the global precious metal markets with competitive spreads and leverage.

Precious Metal Trading

Trading precious metal CFDs (Contracts for Difference) allows you to speculate on the price movements of metals like gold, silver, platinum, and palladium without owning the physical asset.

Select the precious metal you want to trade. Popular choices include:

- Gold (XAU/USD)

- Silver (XAG/USD)

- Platinum

- Palladium

Why trade with Swift Trader

Precious Metal Facts

- Up to 1:1000 leverage

- Razor-thin spreads from 0.0 pips

- Deep liquidity

- Trade 24 hours a day, five days a week

- Trade in any direction, short or long, maximising trading opportunities

We provide some of the tightest spreads, with an average spread of just 0.1 pips. Our combination of competitive spreads and low-latency, enterprise-grade infrastructure makes Swift Trader the perfect choice for active day traders and those utilising Expert Advisors. The table below displays our minimum and average spreads for all major currency pairs.

How Trading Metals CFDs Work

Trading precious metal CFDs (Contracts for Difference) allows you to speculate on the price movements of metals like gold, silver, platinum, and palladium without owning the physical asset. Select the precious metal you want to trade. Popular choices include:

- Gold (XAU/USD)

- Silver (XAG/USD)

- Platinum

- Palladium

Key considerations

- Decide on a Trading Position: Going long (Buy): If you believe the price of the metal will rise. Going short (Sell): If you think the price will drop. Precious metals tend to be influenced by factors such as inflation, geopolitical risks, and currency movements, so consider market conditions.

- Use Leverage: CFD typically offer leverage, allowing you to trade a larger position than your initial investment. For example, with 10:1 leverage, you can control $10,000 of gold with just a $1,000 deposit. While leverage increases profit potential, it also amplifies losses, so use it cautiously.

- Monitor Market Trends and News: Precious metal prices are heavily influenced by economic events, central bank policies, inflation rates, and political uncertainty. Stay updated with financial news and use technical analysis tools like charts and indicators to make informed decisions.

Discover our competitive spreads

MT-5

- Standard

- Mini

- Micro

- PRO

- ECN

| Symbol | Bid Price | Ask Price | Spread |

|---|

Benefits of trading precious metal CFDs:

Profit in Both Directions: With CFDs, you can speculate on both rising and falling prices of precious metals. This means you can potentially profit whether the market is bullish or bearish, as long as your prediction is correct.

Market Liquidity: Precious metal markets, especially for gold and silver, are highly liquid. This ensures smooth trade execution, tighter spreads, and better pricing, making it easier to enter and exit positions at competitive prices.

Diversification: Precious metal CFDs can be a useful tool for diversifying your portfolio. Metals like gold and silver often act as a hedge against economic instability or inflation, providing balance to portfolios that are heavily invested in stocks or currencies.

What Precious Metal CFDs to trade:

Gold (XAU/USD): The most popular precious metal CFD, often used as a hedge against inflation and economic instability.

Silver (XAG/USD): Known for its industrial use and volatility, silver is another highly traded metal CFD.

Platinum (XPT/USD): Used in the automotive industry and jewelry, platinum offers a smaller but distinct market for traders.

Palladium (XPD/USD): Primarily used in automobile catalytic converters, palladium CFDs are less traded but can be very volatile and profitable.

Liquidity Providers:

Role: Liquidity providers are financial institutions that facilitate trading by offering buy and sell prices for currency pairs. They ensure that traders can execute trades efficiently and at competitive prices.

Types: Major banks and financial institutions act as liquidity providers. They offer tight spreads and deep liquidity, which helps to maintain market stability and minimise slippage.

Technology and Infrastructure:

Equinix Servers: Swift Trader utilises Equinix servers, which are strategically located in major financial hubs to ensure low latency and fast execution times. Equinix’s high-performance infrastructure enhances connectivity and reliability, providing traders with a seamless trading experience.

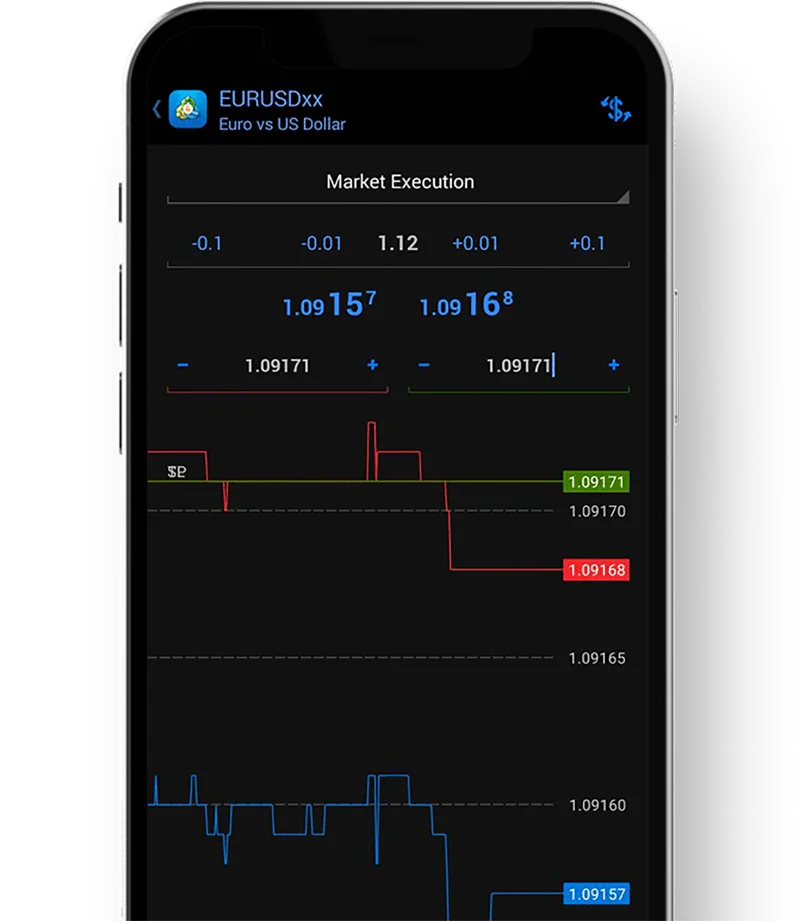

Advanced Platforms: Our trading platforms, MT5, is designed to handle high-frequency trading and large volumes with minimal latency. Features include real-time quotes, advanced charting tools, and customisable trading indicators.

Key benefits of Precious Metal CFDs with Swift Trader

Forex CFDs provides a number of benefits which must be weighed against the risks of using them. Some of the benefits of Forex CFDs are as follows:

Automated trading

Custom leverage options

Hedge your exposure

Trade from anywhere

Profit in both ways

Tailored to suit

Why trade Precious Metal Markets with Swift Trader

Discover why traders choose Swift Trader for its unbeatable combination of advanced tools, fast execution, and competitive trading conditions.

Sincerity of Customer Support

Raw spreads from 0.1 pips

Micro lots available

Up to 1:400 Leverage

Negative Balance Protection

300+ trading instruments

Crypto as a funding method

Fast withdrawals

3 Step account opening

Swift Trader Commodity CFDs. What we offer.

By offering commodity CFDs, Swift Trader provides traders with the tools and infrastructure needed to navigate the dynamic forex market and capitalise on trading opportunities.

COMMODITY TRADING EUR/USD & GBP/USD

Commodity CFDs trading examples

Successful Trade Example:

Open Position

Closing Position

Result

Unsuccessful Trade Example:

Open Position

Closing Position

Result

Trade CFDs Like a Pro with MetaTrader 5

- Real-time price quotes

- Advanced charting tools

- Customisable trading indicators

- One-click trading

Ready to get started with Commodity CFDs?

Sign up and access the Global Markets in less than 3 minutes

Swift Trader offers one of the most competitive Forex trading experiences globally. Gain access to the world’s largest and most liquid market with raw spreads starting as low as 0.0 pips.