Trade Commodity CFDs

Access global commodity CFDs with competitive spreads and leverage.

Commodity Trading

Commodity CFDs are financial derivatives that allows traders to speculate on the price movements of various commodities without owning the physical asset. This can include trading on the prices of agricultural products, energy resources, and precious metals. Key commodities in the CFD market include crude oil, natural gas, gold, silver, wheat, and coffee.

CFD commodities trading allows traders to profit from price movements in either direction—rising (buying or “going long”) or falling (selling or “going short”). This means traders can take advantage of both bullish and bearish market conditions. When you trade CFDs, you’re speculating on the difference between the entry and exit price of the commodity.

Why trade with Swift Trader

Commodity Facts

- Up to 1:1000 leverage

- Razor-thin spreads from 0.0 pips

- Dedicated Customer Service

- Trade 24 hours a day, five days a week

- Oil, Natural Gas, Coffee are just some of the most popular Commodities CFDs

Swift Trader provides some of the tightest spreads in the market. Our combination of competitive spreads and low-latency, enterprise-grade infrastructure makes Swift Trader the perfect choice for trading commodity CFDs and those utilising Expert Advisors.

How Trading Commodity CFDs Work

With CFDs, traders can predict whether the price of a commodity will rise or fall. A CFD is an agreement between a trader and a broker, which ends when the contract is closed. If a trader expects a price increase, they will buy the CFD. Conversely, if they anticipate a price drop, they will take a “short” position. When the contract ends, the trader and broker exchange the difference between the commodity’s initial and final price.

Commodity CFD Trading Example:

- if you buy a CFD on gold at $1,500 and close the trade when gold reaches $1,600, you earn a $100 profit. However, if the price falls to $1,400, you would incur a $100 loss.

- One unique aspect of CFDs is the ability to "short," meaning you can profit from falling prices as well as rising ones. This makes CFDs attractive in volatile markets. Additionally, CFDs are relatively simpler to trade compared to options or futures, and their ease of entry and exit has contributed to their popularity.

Discover our competitive spreads

MT-5

- Standard

- Mini

- Micro

- PRO

- ECN

| Symbol | Bid Price | Ask Price | Spread |

|---|

Brief History of Commodity Trading:

Origins: Commodity trading has a long and rich history, tracing its roots back to ancient civilisations and evolving into a sophisticated global marketplace.

Modern Era: With the advent of technology and the internet, commodity trading has become accessible to retail traders. Electronic trading platforms revolutionised the market, allowing for real-time trading and greater transparency.

Commodity Markets:

The most actively traded commodities compiled by the Futures Industry Association (FIA) are WTI Crude Oil, Brent Crude Oil, Natural Gas, Soybeans, Corn, Gold, Copper, Silver

Metal Commodities: Gold, Copper, Silver

Energy Commodities: The top oil and energy market WTI Crude Oil (CrudeOIL) , Brent Crude(BRENT_OIL), Natural Gas (NATURAL_GAS)

Agriculture Commodities: The top agriculture commodity futures are Soybeans, Corn, Wheat, Coffee.

Liquidity Providers:

Role: Liquidity providers are financial institutions that facilitate trading by offering buy and sell prices for commodities. They ensure that traders can execute trades efficiently and at competitive prices.

Types: Major banks and financial institutions act as liquidity providers. They offer tight spreads and deep liquidity, which helps to maintain market stability and minimise slippage.

Technology and Infrastructure:

Equinix Servers: Swift Trader utilises Equinix servers, which are strategically located in major financial hubs to ensure low latency and fast execution times. Equinix’s high-performance infrastructure enhances connectivity and reliability, providing traders with a seamless trading experience.

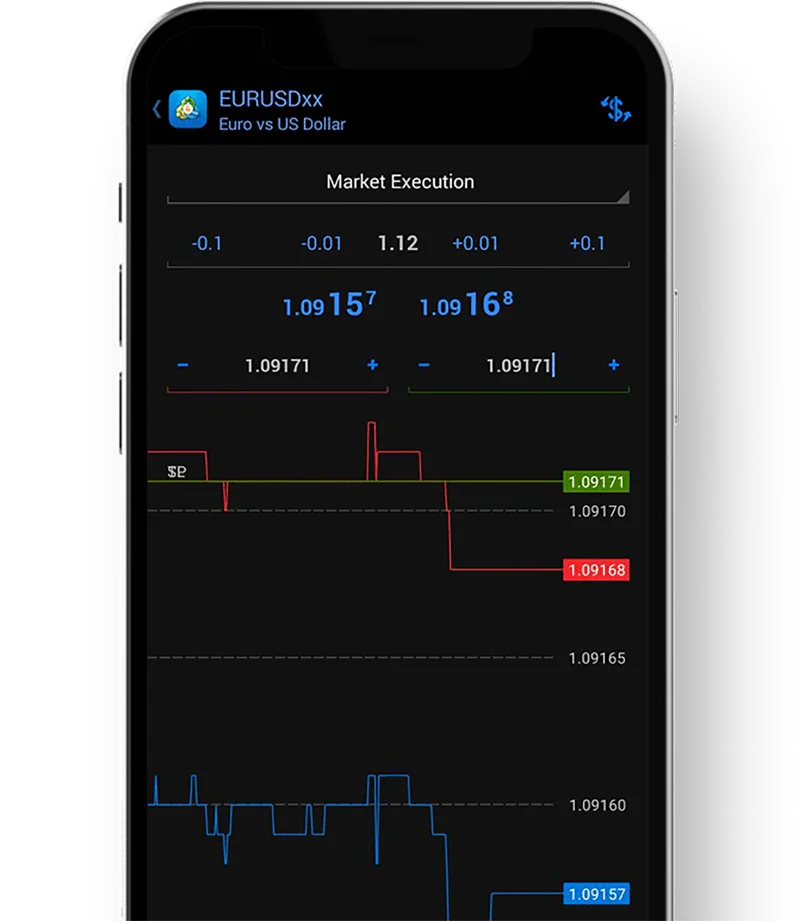

Advanced Platforms: Our trading platforms, MT5, is designed to handle high-frequency trading and large volumes with minimal latency. Features include real-time quotes, advanced charting tools, and customisable trading indicators.

Key benefits of Commodity CFDs with Swift Trader

Commodity CFDs provides a number of benefits which must be weighed against the risks of using them.

Automated trading

Custom leverage options

Hedge your exposure

Trade from anywhere

Profit in both ways

Tailored to suit

What makes Swift Trader preferred by traders

Discover why traders choose Swift Trader for its unbeatable combination of advanced tools, fast execution, and competitive trading conditions.

Sincerity of Customer Support

Raw spreads from 0.1 pips

Micro lots available

Up to 1:400 Leverage

Negative Balance Protection

300+ trading instruments

Crypto as a funding method

Fast withdrawals

3 Step account opening

What Swift Trader Offers

We provide commodity traders with the tools and infrastructure needed to navigate the dynamic markets and capitalise on trading opportunities.

Trade a wide range of commodities including Precious Metails, US crude oil, coffee and natural gas.

Benefit from tight spreads and leverage up to 1000:1, allowing you to maximise your trading potential.

Trade CFDs Like a Pro with MetaTrader 5

- Real-time price quotes

- Advanced charting tools

- Customisable trading indicators

- One-click trading

Ready to get started?

Sign up and access the Global Markets in less than 3 minutes

We offer one of the most competitive CFD experiences globally. Gain access to the world’s largest and most liquid market with raw spreads starting as low as 0.0 pips.